Spotlight on: Financial Technology

In our latest journal, Ollie Smith provides his insight into the growing FinTech market, and recent M&A activity in the space.

The rise of ‘FinTech’

It is no secret that M&A activity went into overdrive following the initial Covid-19 lockdown in 2020, with both deal valuations and volumes experiencing record highs in many areas of the market. Perhaps in no sector was this more evident than in the world of Financial Technology (‘FinTech’).

As with other industries, demands for digitalisation, increased data availability, ease of access and improved user experience have led to a number of new companies emerging to disrupt the status quo. Pertinent examples include the rising popularity of digital neo-banks such as Monzo, Starling and Revolut; new generations of payments companies offering immediate settlement such as Stripe and checkout.com; and the emergence of a new form of consumer credit in buy-now-pay-later (BNPL) providers such as Klarna and Afterpay.

In the post pandemic boom, many of these companies were involved in huge deals as global investors flooded the market in search of the next big thing. This included a number of non-traditional venture capital (VC) investors such as Softbank and Tiger Global who had significant funds to deploy in a short space of time, leading them to invest in earlier stage FinTech’s at significant valuations.

It wasn’t just institutional investors either, there was significant consolidation amongst large corporates, as they sought to enhance their technological capabilities and eliminate future competition. Some of the most notable corporate deals included:

- JP Morgan’s acquisition of investment management platform Nutmeg;

- Abrdn’s acquisition of Interactive Investor, another online investment management platform;

- Block (Jack Dorsey’s US listed payments company, formerly known as Square) acquiring Afterpay, an Australian-based BNPL provider.

A number of big-tech firms also sought to get in on the FinTech boom with the likes of Apple and Amazon launching their own products, often in partnership with some of the traditional banks. For instance, Amazon now offer ‘Instalments by Barclays’ a BNPL option which offers purchases over £100 to be spread across monthly instalments over 3-48 months. Apple, on the other hand, acquired Credit Kudos, a software developer that analyses consumer data to assess credit risk, leading to speculation that they will launch a UK credit card or BNPL offering.

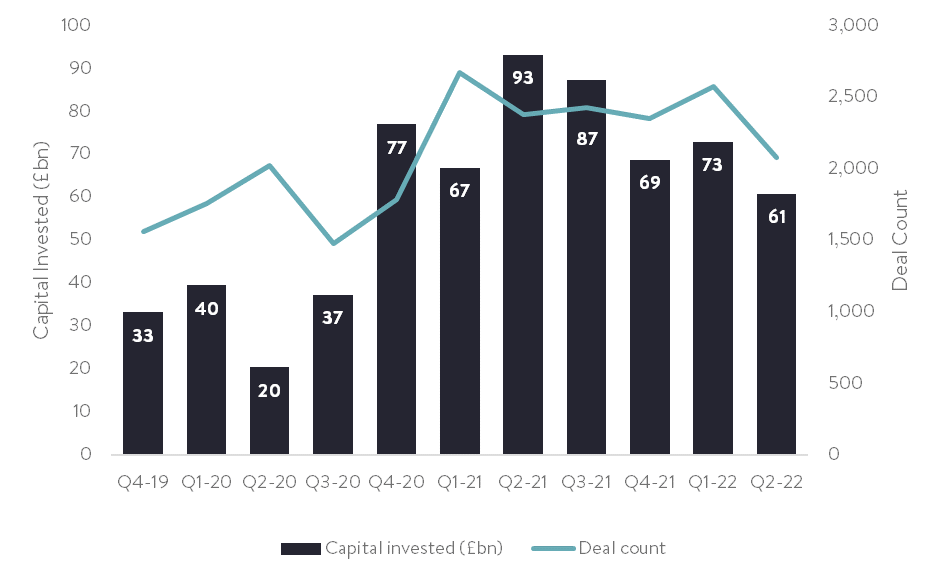

According to PitchBook data, 2021 saw all four quarters return record levels of global deal volumes in FinTech assets, with over 2,200 deals in each quarter. Q2 and Q3 were also record quarters in terms of transaction values, with an estimated £180bn of capital invested across the middle half of the year. Whilst capital investment declined slightly in the two subsequent quarters to ~£70bn, deal volumes remained at similar levels and market sentiment remained strong.

The current state of play

However, despite a previously booming market, FinTech has certainly not been immune to the downturn seen in 2022. If anything, FinTech valuations have been hit harder than the wider technology sector, where geopolitical uncertainty, inflation and increased interest rates have led to a sell off of major tech stocks.

Significant listed FinTech players including PayPal (67%), Block (76%) and Wise (52%) are all currently trading at discounts greater than half the value of their 52 week high. Affirm, a US listed BNPL provider is also 87% down, whilst the equivalent metric for the ‘Big 5 tech firms’ is a 37% discount. The NASDAQ index, often considered as a barometer for the wider technology market, is currently 33% down on its 12 month peak.

This compression of valuations in the public markets has subsequently spilt over into private companies. For instance, the latest financing round at Klarna came in at a reported valuation of $6.7bn, a staggering 85% decrease on the $45.6bn it achieved in June 2021. Payments company Stripe also had a reported 28% mark down on its valuation in July. This has coincided with the non-traditional VC investors (such as Tiger Global and Softbank) pulling away from private markets and returning to focus on more conservative short-term approaches.

There are a number of theories as to why FinTech valuations have been harder hit than the other industries. Perhaps the most common hypothesis is that previously, most FinTech’s were valued in line with technology companies, often using SaaS revenue multiples. However, market sentiment is shifting and valuations are moving closer to the significantly lower multiples seen amongst traditional financial services firms, who generally have lower margins. This is occurring as many new FinTech’s have grown their revenues significantly, but have yet to demonstrate that they can absorb significant market shocks which could impact their customers behaviour, such as increased defaults and reduced consumer spending.

Another argument is that the post-pandemic boom disproportionately benefited FinTech’s and therefore the steeper declines represent an equivalent over-correction. Others point to the often nascent business models and lack of proven profitability at many FinTech firms. This leaves their valuations increasingly exposed to higher interest rates as investors become more inclined to invest in businesses which can generate immediate returns and subsequently reduce their reliance on future growth expectations, which had previously driven the high valuations.

However, despite negativity reported in the wider press, there continues to be activity within the sector:

- In June SumUp raised €590m at a valuation of €8bn, albeit at a valuation reportedly lower than the €20bn it was initially reported to be targeting.

- European insurance comparison platform Wefox raised $400m at a valuation of $4.5bn and managed to buck the trend of down valuations having previously been valued of $3bn in 2021.

- Saitspay, an Italian payments network, achieved unicorn status with a €320m raise with a valuation in excess of €1bn.

- At the other end of the scale, UK-based payments start-up Sequence, raised $19m from Andreesen Horowitz at an undisclosed valuation.

What’s next? The view from WY

It is clear, that much like other sectors, investors are currently cautious when investing in FinTech assets. Although public company valuations are down and there have been a number of high profile down valuations in the private markets, there continues to be significant dry powder within the PE and VC landscapes. Institutional investors might therefore be under pressure to deploy committed capital, driving strong competition for the most attractive assets. As a result, we still expect that significant cheques will continue to be written for the right businesses, most likely those with high quality proprietary technology and strong financials. Key factors that investors will look for are likely to be strong growth in repeatable / recurring revenue with limited churn, as well as a clear pathway to profitability and positive cash flows. Furthermore, given current sentiments towards exposure to consumer markets, it is also likely that investors will be more attracted to B2B products and solutions.

As valuations are reduced, it is likely that investors will seek to make opportunistic acquisitions. In particular, traditional large corporates that have been lagging behind on their investment in technology might seek to purchase capability that they have failed to develop in house, leading to a wave of consolidation across the sector. For instance, we can expect to see more deals like HSBC’s recent $35m investment into digital bank Monese.

The FinTech market is still seen as an area with significant growth potential. FinTech Futures are forecasting a global market size of $41bn by 2030, at a CAGR of 16.5% from 2022. So whilst many are predicting a slight slow-down in deal activity, we expect that there will continue to be many compelling propositions for investors with capital to deploy, or strong strategic incentives.

WY Partners offers specialist M&A advice to businesses who are seeking to either buy, sell or raise investment at the intersection of media and technology.

Contact Ollie Smith at osmith@old.wypartners.com if you have any questions or wish to discuss anything further.