Spotlight on: moblie gaming

Mobile gaming has experienced significant growth in recent years. With a valuation of ~$95bn in 2019, the global mobile gaming market is forecast to increase to ~$420bn by 2026, at a CAGR of 24%.

What’s happening in the industry?

Mobile gaming has experienced significant growth in recent years. With a valuation of ~$95bn in 2019, the global mobile gaming market is forecast to increase to ~$420bn by 2026, at a CAGR of 24% (Source: Yahoo Finance). The proliferation of smartphones across the world has been the major driver of this growth, as more and more people have access to the internet.

The pandemic and subsequent restrictions imposed on the population were a key driver behind this explosion in growth during 2020 which is evidently still being felt today. Although not quite at the peak of Q2 2020, the number of active mobile gaming users in the UK remains 50% higher than pre-pandemic levels (Source: Cybercrew).

While the overall trends of increasing user numbers and in-game spending are, of course, extremely positive for the mobile gaming market, not all recent developments are cause for celebration. Apple’s removal of IDFA (Identifier for Advertisers) is a once-in-a-generation change to the advertising ecosystem that mobile advertisers will have to adapt to quickly.

Apple’s privacy revolution changing the game

Apple’s decision to remove the IDFA, means mobile gaming companies are no longer able to measure marketing campaigns the same way as before. This change is likely to be felt predominantly by mobile games that rely heavily on user targeting and are monetised through advertisements. Leveraging first-party data will play a critical role in building durable and valuable customer relationships. Advertisers now need to pursue alternative solutions to gather and understand their user data.

This includes using app clips as a way to promote organic app discovery, encouraging users to create accounts when they interact with the app clips, customising all current push notifications with highly targeted messages, integrating in-app messages to reach active users, and integrating email marketing to communicate with users who install apps and create accounts. These are just a few ways mobile developers can future-proof their apps and take advantage of the IDFA update.

One of the most important factors that will help developers overcome these changes is to prioritise user experience design and customer experience strategy. Now it is even more important for businesses to shift their marketing strategies to focus on customer engagement rather than acquisition. A flawless user experience, exceptional product development, and a solid retention strategy are all part of this. Companies are investing more heavily in contextual targeting, which means they will target the environment which the user is in, rather than targeting the individual user directly.

The bottom line is that IDFA hasn’t taken personal data away entirely. By weaving consent workflows into user touchpoints rather than relying on consent signals, app publishers can still access first-party data that gives advertisers confidence. Therefore, we remain confident that mobile developers will succeed in adjusting to the new regulation over time.

Recent M&A and fundraising activity in mobile gaming

In the last two years, the market has seen sizeable transactions completed by both established mobile gaming businesses, and by other corporates looking to quickly gain a foothold in mobile gaming, as they seek to capitalise on the changing behaviours of individuals by pivoting into adjacent verticals. For example, Microsoft’s $68.7bn acquisition of Activision (developer of Candy Crush), which is the largest gaming deal in history. Electronic Arts (EA Games) have also been making significant strides in the industry recently, with the acquisitions of Glu Mobile ($2.1bn), Playdemic ($1.4bn) and Codemasters ($1.2bn) as they look to expand their footprint in mobile gaming.

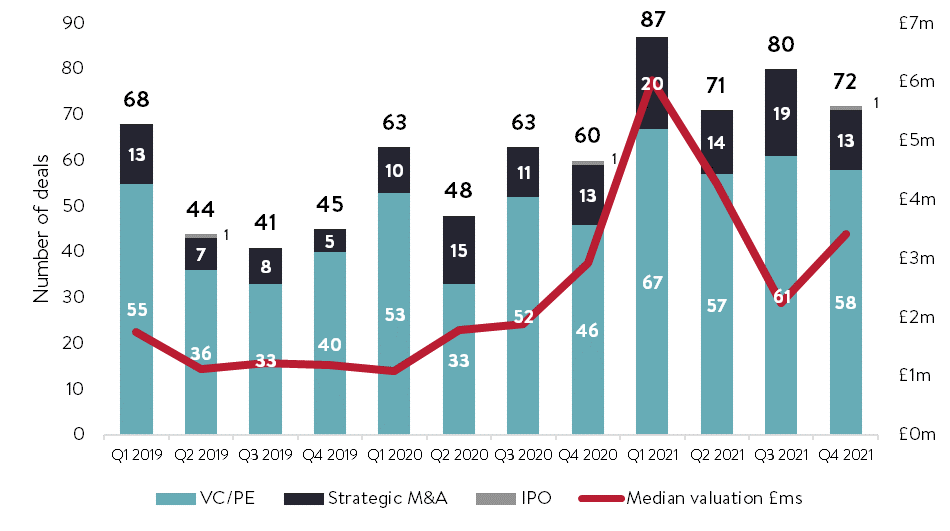

Mobile gaming deals since January 2019

Venture capital (VC) funds and Private Equity (PE) have been the principal drivers of the increased deal flow as they accounted for approximately 80% of the transactions last year. During this period, institutional investors and strategic acquirers poured ~£14bn into mobile gaming companies, which comfortably eclipses the ~£2bn invested into the space in 2019. The top six most active funds made a total of 32 acquisitions: Play Ventures (6), Sisu Game Ventures (6), Makers Fund (5), VGames (5), Golden Ventures (5) and Modern Times Group MTG (5) (Source: Pitchbook). Other notable deals in mobile gaming include:

- Roblox completed its direct listing on the New York stock exchange, which valued the company at $42bn

- ByteDance (owner of Tiktok) acquired Moonton, a developer of mobile role-playing games based in Shanghai, for $4bn

- Embracer Group have raised £1.3bn since April 2020 from a consortium of investors led by CPP Investments

- Embracer Group acquired Borderlands developer Gearbox Entertainment for $1.4bn, and mobile developer Easybrain for $765m

- Zynga acquired Peak (Software Entertainment) for $1.85bn and Small Giant for $718m

- Scopely acquired GSN Games, a mobile gambling games studio for $1bn

What’s next for mobile gaming?

Unprecedented conditions that arose during Q2 2020 provided a favorable environment for mobile gaming growth globally. While we think it is unlikely that the recent peaks in user activity will be replicated in the short term, we do believe that the proliferation of smartphones, particularly across developing countries, will provide a robust foundation for the market’s continued expansion over the coming years.

We also expect that the forthcoming deployment of 5G will broaden the potential mobile gaming user base as gameplay quality improves dramatically, with response times as low as five milliseconds, giving players a gaming experience which promises to be smoother than ever (Source: Cybercrew).

Cameron Hay, a Manager from WY Partners, believes: “Overall we are bullish on the long term trends in the mobile gaming space and expect this sector to continue attracting investment from both institutional investors and strategic acquirers in the short to medium term.”

WY Partners offers specialist M&A advice to businesses who are seeking to either buy, sell or raise investment at the intersection of media and technology.

Find out more about what we do here.

Contact hello@old.wypartners.com if you have any questions or wish to discuss anything further.