The Future of Fitness

Cameron Hay, an avid health and fitness enthusiast at WY Partners, provides his insight into the ever changing eHealth market, and recent investment activity in the space.

“…we have never been as bullish as we have been with Myzone and also the future of the fitness industry.”

– Dave Wright, Founder of Myzone.

The current state of FitTech

The fitness and technology sector has continued to evolve over the past decade, seeing a huge rise in companies and products available in the marketplace. In Europe alone, over $23 billion was invested in the technology ecosystem in 2018 (Source: The State of European Tech 2018, atomico). The UK is home to the largest proportion of FitTech businesses in Europe.

FitTech has been fuelled by the spending power of a generation that expects everything to be connected through a smartphone and available at their fingertips. This, coupled with the ongoing expansion of the health and wellbeing sector whereby consumers become evermore demanding of their personal analytics (e.g. heart rate, hours of sleep, steps walked, calories burnt), has led to an explosion of growth and inward investment into the sector.

Covid accelerating trends in FitTech and wearables

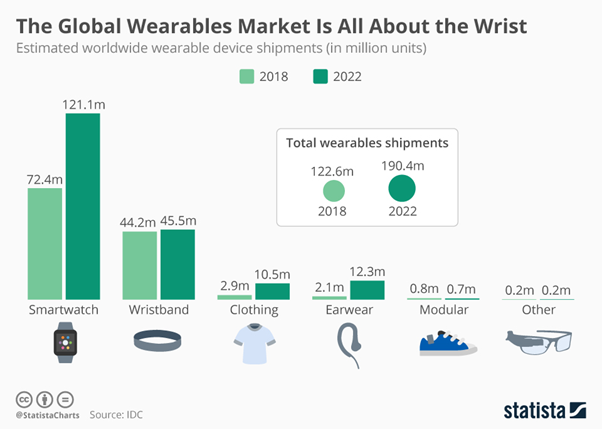

The pandemic has accelerated trends in fitness technology with people being forced to exercise away from gyms and investing in other means of monitoring performance. One area which has seen significant growth is wearable technology, the most popular of which has been the heart rate monitor. The rise in remote working and interest in health monitoring is driving growth in this sector and is not expected to change any time soon, with the wearables market is set to be worth $64 billion by 2024 (Source: GlobalData).

We spoke with Dave Wright, Founder of Myzone (a market leading wearable fitness tracker) about his thoughts on how the pandemic has changed the industry.

The pandemic has allowed gym classes to become more accessible to consumers through online platforms, especially to people who would not otherwise go to a gym. There will always be a proportion of people who prefer one to one contact to supplement the benefit of on-demand fitness and subsequently, a new group of gym goers has emerged. Dave remarked that “for every former gym goer who has decided to not go back to a gym there are 3 or 4 new people who had never exercised but have embraced home workouts and want to go to a gym”.

Accessibility and connectivity has always been at the heart of Myzone’s business strategy so it’s not surprising that 2020 was the most profitable year in Myzone’s 10-year history, seeing significant revenue growth year on year.

Deals in the FitTech space

As the pandemic has highlighted the importance of personal health, FitTech has attracted a lot of M&A and fundraising activity in 2021. Google has demonstrated their interest with the acquisition of fitness wearables pioneer, Fitbit, and their partnership with Samsung to merge their wearables operating systems.

Private equity has been targeting the fitness industry in recent years through physical fitness facilities and the technology supporting them, thanks to the high gross margins and recurring revenue of these businesses. For example, Advent has recently merged two of their portfolio companies (Clearent and Transaction Services Group) to create Xplor Technologies to capitalise on the growth of the worldwide fitness industry. We expect to see continued interest in this sector from institutional investors as countries come out of lockdown and people transition away from home workouts.

Other notable acquisitions in the FitTech space include:

- Peloton’s acquisition of fitness equipment maker Precor for $420m

- Therabody’s $34m acquisition of PowerDot (a developer of a connected wearable muscle training device)

- Medopad’s $10m purchase of a psychological wellness application Bio Beats

The fundraising market has also been very active as investors try to find the next Peloton and Fitbit. The most notable fundraise in the FitTech space was Fiture Technology (a home workout solution), who raised $300m in their Series B led by All-Stars Investment. The wearables space specifically has been attracting investor attention following the recent M&A activity. This includes Benevolent Capital’s investment into Oura, who developed a ring which tracks sleep, has raised £187m to date, and FIGUR8 (a developer of wearable sensor technology which collects movement data) raised $12m in a round led by Taiwania Capital.

Other notable fundraises include:

- Lite Boxer (developer of interactive boxing platform) recently raised $20m in a round led by Nimble ventures

- BayMed Venture Partners led the $12m investment round into VitalTech

- Lenus health (a practice management platform for nutritionist and fitness professionals) raised EUR50m in a round led by EQT Ventures

- Motosumo’s $6m raise led by Magenta Partners

- doing lab, a company that calculates calories in food via photograph using AI, raised £2.7m from a consortium of VC funds including Insight Equity Partners, Naver D2 Startup Factory and GC Pharma

FitTech will continue to grow

Digital and wearable fitness technologies are seamlessly integrated into our everyday lives. The gyms of the future will be a hybrid, combining in-person and online offerings, and gym members will be tracking their progress and working out both in the gym and at home.

James Cronin of Rockstar Fitness is one of many personal trainers who has adopted a hybrid gym model, splitting his time 50/50 between online and in-person coaching. Fitness tracking has improved which has allowed people to work out effectively at home – trainers are able to monitor clients more easily and provide feedback remotely.

Myzone recently launched MZ-remote which is a live virtual gym training tool that allows you to work out with other people from your network from the comfort of your own home, and displays heart rate feedback of all participants on once screen. Myzone’s latest heart rate tracker can be used on the chest, arm or wrist, and is half the size – making it even easier to track progress on the go.

Cameron Hay, Manager at WY Partners, believes “the recent activity in the FitTech and eHealth should continue in 2021 as now, more than ever, both individuals and organisations have never been more aware of the impact of poor mental and physical health. Furthermore, the recent activity has spanned a wide range of areas including fitness equipment manufacturers, developers of wearable technology, and software business that specialise in the fitness sector as investors look benefit from the upcoming growth in the sector.”

Thank you to Dave Wright Founder of Myzone, and James Cronin from Rockstar Fitness for their valuable input in helping us to write this article.

Find out more about what we do here.

Contact Cameron Hay at chay@old.wypartners.com if you have any questions or wish to discuss anything further.